ThoughtFull Resources

ThoughtFull Resources

- Jul 12, 2022

-

3 min read

The Ultimate Bear Market Survival Guide: Mental Health Edition

Source: Pexels

The stock market seems like it’s going through a free fall. Along with the rising costs of living, these financial upheavals are indeed a blow to our mental health as much as our wallets.

The psychological effects of market crashes and declines in wealth are a serious matter. For example, research saw staggering increases in depression rates during the 2008 financial crisis (1).

Given what we know, we should use this awareness to manage frayed emotions during times of financial uncertainty. Only then can we further prevent costly mistakes that bog us down physically, emotionally, and financially.

What’s going on in the stock market?

Source: Pexels

The S&P 500 fell 3.88%, marking its lowest level since March 2021 and bringing its losses from its January record to more than 21% (2). They call this a bear market, an occurrence when the value of a stock market index, such as the S&P 500 stock index, drops at least 20%.

Watching your hard-earned money fall in value feels awful. Nobody likes to see their portfolio plummet 20% or more. More so, the media is filled with fear-mongering headlines that continue to impair our mental health.

While it’s okay to feel sad, angry, frustrated, and scared, it’s important to know that every investor is likely to face multiple bear markets during their lifetimes. The market is also a leading indicator, which means it usually falls before it eventually goes up again.

Yet, it’s still vital that we develop some mental tools that help us ride through the rough waves of this bear market.

Five Ways to Take Care of Your Mental Health During This Bear Market

Source: Pexels

We now understand what a bear market is, as well as its inevitability. So, let’s put things into context and explore actions to preserve your wellbeing while we ride this market flux out.

1) Unsubscribe from the charts

It’s tempting to feed your brain hits of dopamine with scary headlines during a bear market. And a surefire way of keeping yourself in the tracks of anxiety is to compulsively check the charts.

We recommend turning notifications off and staying updated only when absolutely necessary. There’s no point feeding your brain constant noise when you’re better off learning something beneficial or spending time with loved ones.

2) Zoom Out

Source: Pexels

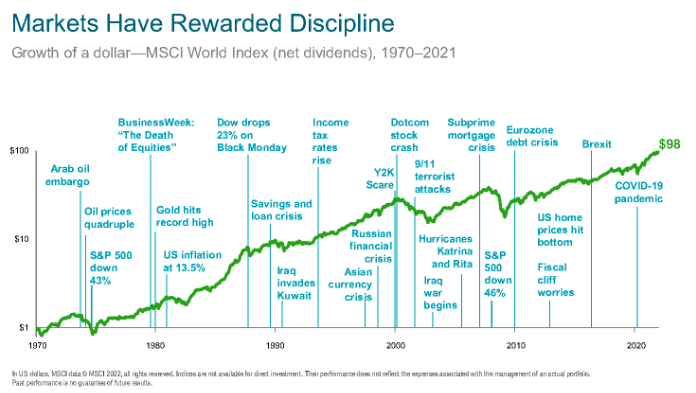

The chart above shows that there have been many bear markets in the past. But when you zoom out and look at the big picture, the market trendline still goes upward. Investors who look at long-term growth, rather than get-rich-quick schemes, are more likely to be rewarded.

This is also why market timing doesn’t work. And research has shown you don’t need to time markets to have successful investments with good long-term returns (3). Instead, you need to give your investments time for them to grow.

3) Reassess emotions of loss

Loss aversion is a psychological concept stating that our response to losses is stronger than the response to corresponding gains. Applying this to human financial behavior, a study in the Journal of Risk and Uncertainty found that losing money impacts our psyche more than when we gain an equivalent amount.

That’s why we are quick to make impulsive decisions, such as selling our stocks, during market upheavals. But instead of checking out in times of market-induced anxiety, resist the urge to “do something” by reminding yourself of your long-term goals.

4) Curb financial burnout

Stress and worry are inevitable when we see our savings fall by 50% or 60%. Rather than suppressing those emotions, acknowledge that they will come up. Then, find healthy ways to manage them before they fester into burnout.

This begins with taking time out for yourself. Whether it’s walking, cooking, or reading - do something that nourishes you so that you can better cope with financial adversity. It’s generally hard to go wrong by exercising, sleeping, and eating well too.

5) Seek professional opinion

We often seek additional information online to see if there is a better strategy, but the problem is that sources online are often generic and unreliable. And if you ask ten people about the economy, you’re likely to receive more than 10 different answers.

You don’t have to navigate a bear market its decision paralysis alone. Whether it’s a financial advisor or mental health professional, revisiting your investment strategy and money psychology can go a long way. These people can bring you sound clarity because their advice is tailored to your unique situation.

Summary

We get it, watching your money go downhill during a bear market is not fun. It’s normal to feel regretful and want to make changes. But the reality is that we live in uncertain times.

In fact, when are things ever certain? Hence, we need to maintain a clear mind and a keen eye. Always remember that you have a better chance of riding out these money woes when your mental health and overall wellbeing are accommodated for.

Read other Mental Wellness Resources:

We’re Here to Help!

❤️ As a thank you for reading our blog, enter the promo code <TP1> when signing up for our app, ThoughtFullChat to enjoy 3 months of free* mental health support. To find out more, click here https://bit.ly/OP1_pcwbb

*Currently available to all Singapore-based users only.

💖 Not based in SG? No worries! Enjoy 2-weeks of free mental health support on ThoughtFullChat from wherever you are. Download our app on the App Store or Google Play today! Your mental health journey awaits :)

💼 Want to build healthier and more resilient organizations and communities with ThoughtFullChat’s evidence-based coaching and curated employee mental wellbeing programs?

Contact us for a FREE assessment and demo or email us at partnerships@thoughtfull.world